Another good read IMO:

Disclosure: I am long KO. (More...)

Warren Buffett's affection for Coca-Cola (KO) is no secret. From his reported 5 Cherry Cokes a day consumption habit to Berkshire Hathaway's (BRK.A) 400 million share stake - the pair just seems natural. And of course the reasoning is relatively straightforward. Coca-Cola is the quintessential example of what Warren would call a "wonderful" company with a sizable "economic moat." In turn, the underlying business of selling beverages has been an exceptionally rewarding one for shareholders and fans of happiness alike.

I have a similar fondness for Coca-Cola. I could go on and on about the wonders of a half century dividend increase streak or the tangible return on equity figures; however I believe a simple story from Buffett will do the trick:

Coca-Cola went public in 1919. The stock sold for $40 a share. One year later it's selling for $19. It had gone down 50% in one year. And you might think that's some kind of disaster. And you might think that sugar prices increased and the bottlers were rebellious and a whole bunch of other things, you can always find a few reasons why that wasn't the ideal moment to buy it. Years later you would have seen the great depression and you'd see World War 2, and you'd see sugar rationing, and you'd see thermal nuclear weapons, the whole thing. There's always a reason, but in the end if you'd bought 1 share for 40 bucks and reinvested the dividends it'd be worth about $5 million now ... And that factor so over rides anything else. I mean if you're right about the business, you'll make a lot of money. The timing part of it is a very tricky thing. So I don't worry about any given event if I've got a wonderful business ... You can figure out what will happen, you can't figure out when it will happen. You don't want to focus too much on when; you want to focus on what. If you're right about what, you don't have to worry about when very much.

Now admittedly I have before used this precise story here and here when describing lasting investment philosophies. It's a fantastic reminder of what partnering with excellent companies for the long-term can yield. Yet it occurred to me that as great as this sounds in theory, in actuality no individual would be able to accomplish this feat. No one would have invested $40 in 1919, diligently reinvested the dividends for nearly a century and then woke up one day to $5 million.

Obviously it's the ideology that's important, but for the literal crowd out there I thought it might be fun to examine a KO investment over a more practical timeframe. For illustrative purposes let's take your average 65-year old retiree today and rewind the clock back to 1970, 43 years ago. Just entering the workforce, what would have happened if that younger version had the presence of mind to invest in a share of Coca-Cola? Well that's a great question, and I'm glad you asked.

If you use the historical price lookup feature on the Coca-Cola website for January 2nd, 1970 you would find a closing price of $0.86 a share with a split adjustment factor of 96. In other words, a single share of KO would have cost just over $82 in 1970 and would give you claim to 96 shares in 2013. With today's pricing around $38 a share that represents a total investment value of about $3,600 or roughly 45 times what you initially paid. Said differently, every dollar that was invested in KO at the beginning of 1970 would have seen annual capital appreciation of about 9%.

But of course - as the infomercial goes - there's more. We haven't yet included dividends in this wonderful business mix. A quick check to Coca-Cola's dividends page and one finds a pleasantly coincidental dividend history dating back to 1970. During this time KO not only paid but also increased its dividend every single year. In addition, the company split its shares on 6 separate occasions. The starting dividend yield in 1970 - based on a $1.44 annual payout and an $82 share price - would have been an unimpressive 1.75%. Yet what happens in the next 42 years is exceedingly remarkable.

A single share of Coca-Cola stock bought in 1970 for $82 would have netted that partial owner $1,190 in dividends over the years. Think about that: forget capital appreciation, with the dividends alone an investor could have generated nearly 15 times their initial investment without thinking about selling a share. On a cumulative basis, one's initial investment would have been repaid in about 19 years. In total, the dividend compounded by about 17% a year.

If you add the nearly $1,200 in dividend income to the $3,600 in paper worth, that equates to about 58 times ones initial 1970's investment. Put in a different light, that's a very solid - yet certainly not overwhelming - 10% annual compounded gain. There's something to be said for owning a wonderful business that utilizes the "magic" of compounding over the very long-term.

Finally, one could manually go about calculating the total return based on reinvested dividends. Luckily, Yahoo Finance offers a reasonable approximation of this figure by providing Coca-Cola's "adjusted close." On January 2nd of 1970, KO had an adjusted close price of just $0.26 a share. Compare this with today's price around $38 and you find a total yearly compounded return of about 12%. Expressed differently, this represents about 145 times one's money or a roughly $12,000 ending value on that original $82 purchase. And of course the numbers get really interesting once you start investing in multiple shares.

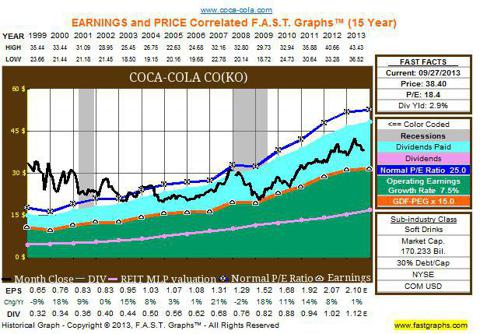

So here's the point of going through all that information: in 1970 Coca-Cola had been a public company for 51 years. In addition, KO had been paying a dividend since 1920 and had increased this payout for nearly a decade. In other words, it wasn't exactly a new concept. Yet an investor still could have found fantastic results. Adding in Buffett's story, and we're talking about practically a century worth of solid returns. And of course the company is much more powerful today than it was back then. Presently you might say that Coca-Cola is still a good company, but it's a bit expensive. You'd like to see it come down a few dollars where it would have a better valuation. And that might very well be true:

We have no way of knowing if Coca-Cola will be able to provide the same solid results for the next investing career as it did for the previous. But I believe this example still carries weight. It alludes to the fact that you don't have to find the next obscure microcap stock to find solid return results. Some of the best investments are profitable companies that are sitting right in front of you. There's a reason why companies continuously make money. Meanwhile, quibbling over a percent or two here or there - while prudent in theory - might force you to miss out of some of the best companies in the world.

If I were to update Buffett's Coca-Cola story, it would go something like this:

By 1970 Coca-Cola had been paying dividends for half a century and was selling for $82 a share. And you might have thought that price was a couple of dollars too high, or the dividend yield was too low or that it had a good run, but it's time to shine in the beverage world was over. You can always find a few reasons why it's not the ideal reason to buy. Years later you would have seen presidential scandals, an oil crisis, double digit inflation, various wars, terrorist attacks and a global financial crisis, the whole thing. There's always a reason, but in the end if you bought 1 share for $82 and reinvested the dividends it'd be worth about $12,000 now. And that factor so overrides everything else. Considering the companies that you want to own for the very long-term is often just as essential as thinking about the valuations that the market is offering.

Link to article and author:

http://seekingalpha.com/article/1722...dispatch&ifp=0