|

|

11-24-2013, 11:36 AM

|

|

Senior Member

|

|

Join Date: Oct 2013

Location: Peoria, AZ

Posts: 2,683

Thanks: 72

Thanked 338 Times in 212 Posts

|

|

Quote:

Originally Posted by GregWeld

With a well blended portfolio of dividend paying investments -- a guy should be able to get about 5% dividend (using current rates/investment costs)… which means it takes ONE MILLION DOLLARS -- to make $50,000 (Fifty thousand dollars) per year in "income". That will be taxed at 20% -- so a NET spendable income of $40,000….. not much is it! But here's the kicker -- you should also be almost debt free at retirement - and you should also be collecting Social Security (maybe 2K a month?) AND your capital should appreciate "on average" over time around 8 or 9%.

|

Again, just being devil's advocate here...but here's a look at this same scenario from my current view. Remember, I have no kids and our siblings have no kids...so no heirs at all to worry about leaving anything to.

Given that, say I take that same million dollars and put it in a CD or likewise investment and pull the same $50,000 a year out of it. That's 20 years minimum of cash flow without taking a single bit of risk. I'll be 67 years old by then, the wife even older and I'll be tired of enjoying my money by then as I've had the last 20 years of freedom with no worries.

BTW, my average ROI for the 15 years I was in the market, 4.5% before taxes. Were there mistakes made, sure...but there were also 3 major corrections during that 15 year period, none of them caused by any actions of mine. And we had plenty of good years as well with well more than 8-9% appreciation. My investment life timing has just sucked.

Like I said in my first post, the investor's lost decade.

I'm an accountant by nature, so I realize that one can make numbers spin just about anyway one wants to given different scenarios. You can make things appear rosier and I can make them appear worse, just by juggling things around. I'm trying to not play that game.

I really am trying to figure out a method by which I can keep up with inflation while incurring minimal risk at the same time. It's almost like I need to look at this as if I was already 67 years old yet I can't pull money out of my IRAs for another 12 years or so without a 10% penalty.

Keep in mind, we have other assets and incomes in place already as well. I'm mainly concerned about the hunk we have in our retirement accounts and taxable investment accounts.

I realize my situation is different and if you'd rather not discuss it in this thread, I understand. I have pretty much exhausted the normal people I would talk to things like this about and welcome a different perspective. I believe that things are different after 2008 and with no signs of QE ending anytime soon, I don't believe anyone knows what is coming around the bend. I do like to talk about it with those that are participating though.

__________________

Lance

1985 Monte Carlo SS Street Car

|

11-24-2013, 02:24 PM

|

|

Lateral-g Supporting Member

|

|

Join Date: Jul 2005

Location: Scottsdale, AriDzona

Posts: 20,741

Thanks: 504

Thanked 1,080 Times in 388 Posts

|

|

Quote:

Originally Posted by SSLance

Again, just being devil's advocate here...but here's a look at this same scenario from my current view. Remember, I have no kids and our siblings have no kids...so no heirs at all to worry about leaving anything to.

Given that, say I take that same million dollars and put it in a CD or likewise investment and pull the same $50,000 a year out of it. That's 20 years minimum of cash flow without taking a single bit of risk. I'll be 67 years old by then, the wife even older and I'll be tired of enjoying my money by then as I've had the last 20 years of freedom with no worries.

BTW, my average ROI for the 15 years I was in the market, 4.5% before taxes. Were there mistakes made, sure...but there were also 3 major corrections during that 15 year period, none of them caused by any actions of mine. And we had plenty of good years as well with well more than 8-9% appreciation. My investment life timing has just sucked.

Like I said in my first post, the investor's lost decade.

I'm an accountant by nature, so I realize that one can make numbers spin just about anyway one wants to given different scenarios. You can make things appear rosier and I can make them appear worse, just by juggling things around. I'm trying to not play that game.

I really am trying to figure out a method by which I can keep up with inflation while incurring minimal risk at the same time. It's almost like I need to look at this as if I was already 67 years old yet I can't pull money out of my IRAs for another 12 years or so without a 10% penalty.

Keep in mind, we have other assets and incomes in place already as well. I'm mainly concerned about the hunk we have in our retirement accounts and taxable investment accounts.

I realize my situation is different and if you'd rather not discuss it in this thread, I understand. I have pretty much exhausted the normal people I would talk to things like this about and welcome a different perspective. I believe that things are different after 2008 and with no signs of QE ending anytime soon, I don't believe anyone knows what is coming around the bend. I do like to talk about it with those that are participating though.

|

Ordinarily I wouldn't say this -- but I have to be honest -- mostly because other people read this stuff and are trying to learn from this thread…

Some folks just plan to fail. I think I have a good understanding of why your investment plan hasn't worked out well for you.

|

11-24-2013, 04:39 PM

|

|

Lateral-g Supporting Member

|

|

Join Date: Jul 2005

Location: Scottsdale, AriDzona

Posts: 20,741

Thanks: 504

Thanked 1,080 Times in 388 Posts

|

|

Lance --

You'd do well by starting at page #1 --- and take a few pages per night --- and try to absorb some of the "info" that's been posted here. This entire thread is about how to THINK - What kinds of questions you should ask about your personal requirements etc…. it's never been about "Dear Abby - what should I personally do with my money". It's not about what stock to buy, despite many stocks used for examples. It's a beginners thread about "investing" in general. And while there are specific questions which require some discussion… Nobody can tell anyone else what's the right way or thing for them to invest in. Todd likes housing - another guy loves Tech - somebody else is young - and someone else is 5 years from retiring. What you will learn is that there are just some fundamentals here. Real basic stuff - that works "in general" - in good markets and bad.

Investing isn't about QE ending today or tomorrow - it isn't about what's going to happen in the future that nobody can predict…. that's why it's about a long term strategy that over time will have people INVEST in great companies - that pay them dividends - that buys more shares - that pays them ever more dividends and builds their nest egg with compounding. There are different strategies discussed for taxable vs non taxable accounts… again depending on the availability etc to the individual.

For investing principals in general - there should be no distinction between accounts or types of accounts --- a person's financial health and retirement depends on ALL OF THEIR RESOURCES…. combined. There's no separation when you're trying to figure out if you have enough to retire… there's just some basic principals about what types of investments are appropriate for a taxable account vs a non-taxable (or rather, tax deferred account - i.e., muni bonds shouldn't be inside an IRA/ROTH etc).

I think that for the people who have read and actually followed this thread and acted on their accounts… that it has for the most part - been productive for them. People are eager to learn and discuss investing "in general" and then act as they see fit for themselves. It's just not a Dear Abbey please help me thread and I'm not going to engage in that type of discussion.

Last edited by GregWeld; 11-24-2013 at 04:57 PM.

|

11-24-2013, 05:23 PM

|

|

Lateral-g Supporting Member

|

|

Join Date: Jul 2005

Location: Scottsdale, AriDzona

Posts: 20,741

Thanks: 504

Thanked 1,080 Times in 388 Posts

|

|

Lance ---

Here's one more "lesson"… about long term "stock market" returns. Note that you said you went to cash in 2011… that means you missed 10% return in 2012. The compounding is done in spikes… up 10 -- down 5 -- up 6 -- down 4 -- down 3 -- up 9. If you're out in the up markets -- then you've completely missed the "total" return for the period. That's why market timing doesn't work. It only works to make you feel good when you can walk around saying "I got out of the market before "X"…. The problem is that you'll also miss out on the next leg up. Investing is about feeling CONFIDENT that over time you're doing what you should be doing. That means then that you have to be invested in stuff that you can be confident in. Whatever that is. If you're not a good stock picker - most are not - then the least a guy should do is go with the best name in a category and trust that they're well run and will be around when you need them. It's not rocket science. A guy doesn't even have to be very smart. It's enough just to know the names of the best run companies and let time do it's thing. It's when people try to out smart the market that they get crushed.

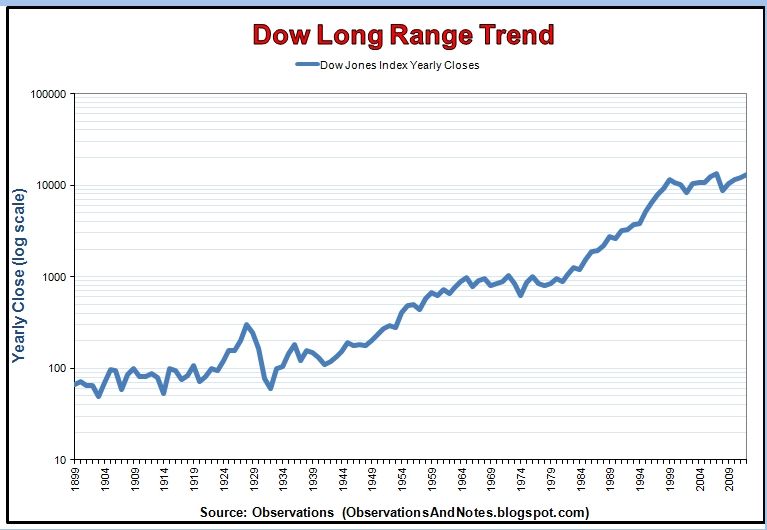

Average Stock Market Return per year: Last 5, 10, 20 ... Years

The long-term, more than 100-year performance: Since 1900 (end-of-year 1899), through 2012, I estimate the average total return/year of the DJIA (Dow Jones Industrial Average) was approximately 9.4% -- 4.8% in price appreciation, plus approx 4.6% in dividends. (Some numbers may not add up due to rounding.)

Since 1929 (year-end 1928 -- i.e., before the crash), through 2012, the return was 8.8% (4.6%, plus 4.2%) [note: see The 1929 Stock Market Crash]

Since end-of-year 1932 (i.e., after the crash): 11.1% (7.0%, plus 4.2%)

The average annual stock market return for the past twenty-five calendar years (since 1987) was 10.6% (7.9%, plus 2.7%) The market was up over 40% before the October 19, "Black Monday," crash. After a significant recovery, the Dow actually closed up 6% for the year.

Stock market returns for the last 20 years (since 1992): 9.6% (7.1%, plus 2.4%) In the middle of one of the longest bull markets in history. [see below for additional 20-year periods]

Returns since 1999 (13 years) -- the dot-com bubble year-end peak: 3.4% (1.0%, plus 2.4%).

Returns for the last 10 years (since 2002): 7.2% (4.6%, plus 2.6%) Year-end trough after the dot-com bubble. [see below for additional 10-year periods]

For the last 5 years (since 2007), 2.6% (-0.2%, plus 2.8%) Year-end peak of housing bubble.

Since 2008 year-end trough after the housing bubble: 13.4% (10.5%, plus 2.9%)

For 2012 the stock market (Dow/DJIA) total return was 10.1% (7.3% plus 2.9%)

2012 year-end dividend yield was 2.7%

|

11-24-2013, 05:38 PM

|

|

Lateral-g Supporting Member

|

|

Join Date: Jul 2005

Location: Scottsdale, AriDzona

Posts: 20,741

Thanks: 504

Thanked 1,080 Times in 388 Posts

|

|

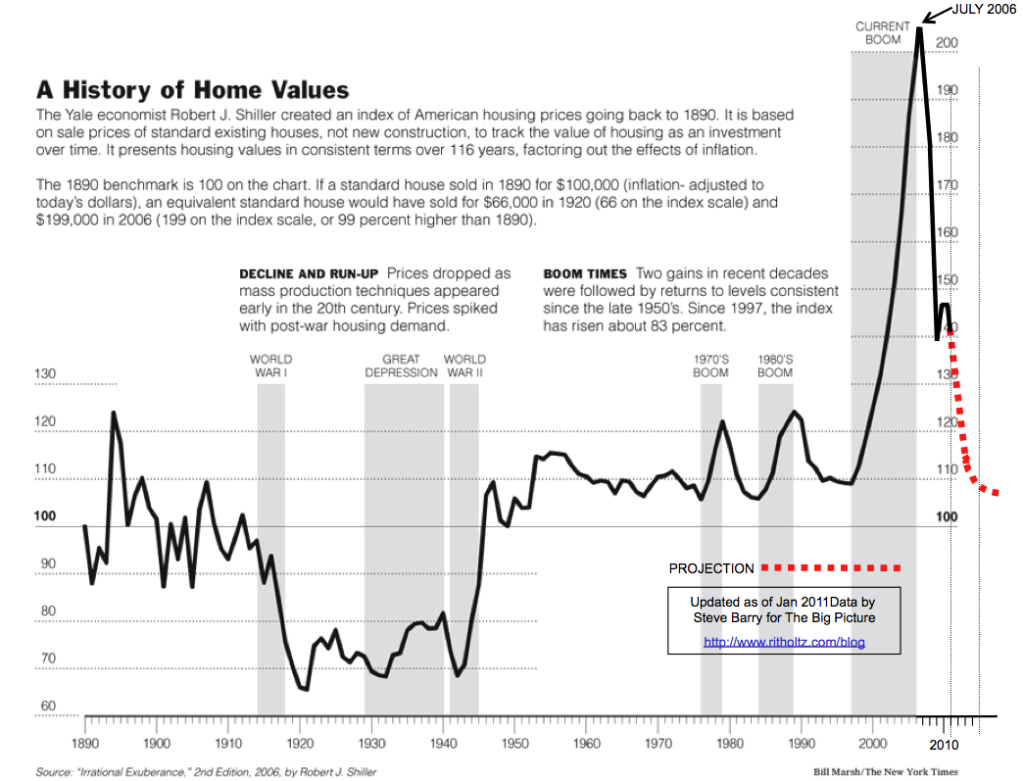

As long as I'm on a roll….. Some folks think real estate is a "sure fired" investment…. so let's compare the ups and downs of the stock market vs the housing market!!

Stock market last 100 years…. Oh to be certain there are periods of not much growth -- thus the dividend!!! Get paid to wait!!

And then the sure fired long term investment in housing….. the last 100 years…

|

11-24-2013, 05:43 PM

|

|

Lateral-g Supporting Member

|

|

Join Date: Jul 2005

Location: Scottsdale, AriDzona

Posts: 20,741

Thanks: 504

Thanked 1,080 Times in 388 Posts

|

|

And not to be left out -- the 100 year chart of BOND yields vs the yield on equities….

BONDS YIELDS IN BLUE…. EQUITIES IN RED. 56 years of equities beating the bonds and 56 years of bonds beating equities. The difference will be is GROWTH in capital - which this chart does not attempt to show.

|

11-24-2013, 05:47 PM

|

|

Lateral-g Supporting Member

|

|

Join Date: Jul 2005

Location: Scottsdale, AriDzona

Posts: 20,741

Thanks: 504

Thanked 1,080 Times in 388 Posts

|

|

Now let's do the MOST REVEALING comparison….. REMEMBER that this is a comparison of what just one hundred dollars would be worth…. a lousy 100 bucks…

LOOK AT THE COMPOUNDED RETURN COLUMN!!!! That's where there is a serious ass kicking being done ---

Not to count out the AVERAGES shown by dated periods at the bottom of the page.

Sorry - I could not paste this page as a picture - so you'll just have to click the link!

http://pages.stern.nyu.edu/~%20adamo...histretSP.html

Last edited by GregWeld; 11-24-2013 at 05:55 PM.

|

11-28-2013, 10:49 AM

|

|

Senior Member

|

|

Join Date: Dec 2006

Posts: 8,692

Thanks: 87

Thanked 215 Times in 120 Posts

|

|

Quote:

Originally Posted by SSLance

Again, just being devil's advocate here...but here's a look at this same scenario from my current view. Remember, I have no kids and our siblings have no kids...so no heirs at all to worry about leaving anything to.

Given that, say I take that same million dollars and put it in a CD or likewise investment and pull the same $50,000 a year out of it. That's 20 years minimum of cash flow without taking a single bit of risk. I'll be 67 years old by then, the wife even older and I'll be tired of enjoying my money by then as I've had the last 20 years of freedom with no worries.

BTW, my average ROI for the 15 years I was in the market, 4.5% before taxes. Were there mistakes made, sure...but there were also 3 major corrections during that 15 year period, none of them caused by any actions of mine. And we had plenty of good years as well with well more than 8-9% appreciation. My investment life timing has just sucked.

Like I said in my first post, the investor's lost decade.

I'm an accountant by nature, so I realize that one can make numbers spin just about anyway one wants to given different scenarios. You can make things appear rosier and I can make them appear worse, just by juggling things around. I'm trying to not play that game.

I really am trying to figure out a method by which I can keep up with inflation while incurring minimal risk at the same time. It's almost like I need to look at this as if I was already 67 years old yet I can't pull money out of my IRAs for another 12 years or so without a 10% penalty.

Keep in mind, we have other assets and incomes in place already as well. I'm mainly concerned about the hunk we have in our retirement accounts and taxable investment accounts.

I realize my situation is different and if you'd rather not discuss it in this thread, I understand. I have pretty much exhausted the normal people I would talk to things like this about and welcome a different perspective. I believe that things are different after 2008 and with no signs of QE ending anytime soon, I don't believe anyone knows what is coming around the bend. I do like to talk about it with those that are participating though.

|

Not to pick on you but I'd like to add some perspective.

One of life's greatest values is helping others. As you grow older, I hope you find some people and charities that you would be happy to leave your stakes to at the end of the day.

Wouldn't it be great to spend a chunk of your retirement helping others with your time and money? That's one of my long term goals.

I don't see how a CD is going to be a sufficient game plan. Right now you are lucky to get 1%. That's $10,000 on $1,000,000. When interest rates go up, so will the returns on CD's but inflation will kick your butt.

The bottom line is you must put your money to work if you plan to become financially independent. There will be plenty of springs of opportunity, you just have to keep your nose in the wind.

__________________

Todd

|

11-29-2013, 06:19 AM

|

|

Senior Member

|

|

Join Date: Oct 2013

Location: Peoria, AZ

Posts: 2,683

Thanks: 72

Thanked 338 Times in 212 Posts

|

|

Net Asset Value…How do we as investors put an actual value on the companies we own, want to own, or want to sell?

I just went through the exercise of updating a financial statement for my partner and something interesting came up. A couple of his business interests are 2 real estate partnerships he bought into in the mid 80s. Of the 9 partnerships he was in at the time, only 2 of them survived. One is a shopping center and the other is a mobile home park.

The shopping center has finally turned the corner and just recently finished paying it’s loan off and the mobile home park is still struggling, but hasn't had a cash call in many years now.

The question came up of how to value the ownership stake in each of these business partnerships on his financial statement. Do you use the cost basis, what the latest partnership balance sheet shows for owner equity, or a multiple of the earnings the partnership pays out each quarter?

Think of the shares of stock each of you have bought in certain companies in the same way. Basically you are in partnerships with the other owners of the company. You have a cost basis in the shares, the stock price dictates the asset value (market value) of the company, and the dividend that is paid out is the income from the company.

The accountant in me wanted to use the balance sheet number, add up the assets, subtract out the liabilities and divide what was left by ownership shares and use that number.

The cost basis really only comes into play after the asset has been sold, used to figure out the tax liability on the sale. It is not typically representative of the net asset value. It is used to figure the total ROI though.

The earnings multiple seemed to be the logical answer. Have any of you ever looked at PE ratios and multiples when trying to put a value on a company you own? Somewhere between 5 and 10 times earnings is considered the “standard” when valuing a privately held company (PE ratios are typically MUCH higher on publicly traded companies). So you take the dividend\distribution said partnership is paying, multiply it by 10, divide by ownership shares and boom, there’s your net asset value…right?

That is what my partner’s financial adviser wanted to use in this instance for the shopping center. It was a justifiable value that looked pretty good on paper too. The thing is, the mobile home park in the scenario above…pays a tiny dividend\distribution. When asked how to put a value on it, the FA said to leave it like it was…using the balance sheet method like I always had in the past. That was a justifiable value just as well, and looked much better on paper than the earnings multiple. The FA has no stake in these assets, he is just helping with the overall picture. The financial statement is prepared to give to the banks that hold notes held by my partner as part of the reporting process. My point is, one can use numbers and how they are arranged to make just about any point they want to on paper.

In reality, what your ownership in this company is really worth…is what someone else is willing to pay for it. In a publicly traded company, the market determines that value. In a privately held company…the only way to tell for sure is to put it up for sale.

In the case of the shopping center mentioned above, the balance sheet shows asset values of close to 8 million dollars. They were paying a dividend\distribution of $800,000 a year before the loan was paid off, now they should be able to pay a dividend\distribution of 1.7 million a year. Ten times earnings would put the company valued at 17 million dollars, right?

Here’s the kicker though. Is the property pumping out great income right now? Sure…after 30 some years of losses, then partial income, then finally getting on the right track and producing…sure it’s paying out good income. Problem is…what do you do with the asset now? If you were to sell the company, the assets are almost completely depreciated…that means the first thing you have to do is recapture all of that depreciation…at regular income tax rates. Then everything above that after your initial cost basis is deducted…is subject to capital gains income tax as well. Not too mention that all of the dividends\distributions that you have been collecting over the past few years have also been taxed as regular income… If one wants to really figure the total ROI over the years accurately, the cost of divesting the asset HAS to be figured into the equation.

So “just don’t sell it” is the answer. Okay, you leave it in the account\trust it is sitting in and you pass away. Anyone check to see what Estate Tax rates are these days? Before that asset gets transferred to your heirs, if the estate is of any size at all, good old Uncle Sam is going to take a fairly significant portion of it. And in most cases, the asset is going to have to be sold at whatever market value is at the time…to raise cash to pay the estate taxes.

My reason for bringing this up in this thread is that it is my belief that one must pay attention to the net asset value of any investment they own. Anything that can affect that value beyond the owners control must be paid attention to by the owner. And there are a lot of things that can affect that net asset value that are beyond the owner’s control.

The 1986 Real Estate tax law changed the way commercial real estate property was depreciated and set that whole industry on it’s ear and affected not only the whole economy, but directly the savings and loan industry and the owners of commercial property across the country. In 2008, the failure of the bond insurance companies (AIG, Lehman, etc) due to involvement in bad CDOs and the resulting meltdown took down the net asset values of everyone’s stock portfolio.

Say one of the good companies you own, good dividend paying company…has trouble making money for a long period for some reason out of their control. See the 2008 recession… Say they have to cut their dividend rate because of cash flow deficits. First thing that happens is their net asset value drops as there are more sellers of the stock than there are buyers. Don’t think for a second that ANY company out there won’t pay attention to their share price dropping and resort to practices that are not in their normal realm to try to prop their share prices back up again. Sometimes these practices work other times they only make things worse (See JCP for one example). You as a shareholder are in the meantime…just along for the ride. You have a choice to make, continue to hold the company even with the reduced dividend rate and hope it comes back, or sell it at a loss and try again with another company. Neither are very good options…and both directly affect the total ROI figure negatively.

Another factor is the “the stock is only worth what someone else is willing to pay for it” scenario. If the large institutional investors decide for whatever reason that the company you own doesn't fit in their portfolio for whatever reason, they can drive the price of a stock down just by flooding the market with sell orders. If there aren't enough other buyers out there to buy up those shares, the law of supply and demand kicks in and the share price goes down. So, what do you do…hold it and hope it turns around? Or sell and cut your losses and try again somewhere else.

I firmly believe that the large institutional investors can drive a market one direction or the other strictly to build opportunities in for them to make more money on the back side. Retail investors are just along for the ride. Don't get me wrong here, this works both ways. I've been on the upside of these deals as well. Sometimes you just catch a wave and ride it...nothing much more fun than when it's going your way. But on paper, neither way makes much sense or is justifiable.

__________________

Lance

1985 Monte Carlo SS Street Car

|

11-29-2013, 07:31 PM

|

|

Senior Member

|

|

Join Date: Jul 2006

Location: San Francisco

Posts: 505

Thanks: 0

Thanked 0 Times in 0 Posts

|

|

The real estate books I have read stress two important points regarding the issues you raise:

1) Once you're IN to investment real estate, the most effective strategy is to be IN for life. Don't sell the asset unless it's for a like kind exchange. Then you can avoid capital gains taxes and depreciation recapture.

2) You should divide your assets up early among your heirs in trusts, sooner rather than later while the value of the asset is less. The trustees will own the asset from here on out, but you retain control thus keeping the distributions flowing to you.

Last edited by sik68; 11-29-2013 at 09:57 PM.

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -7. The time now is 12:13 AM.

|